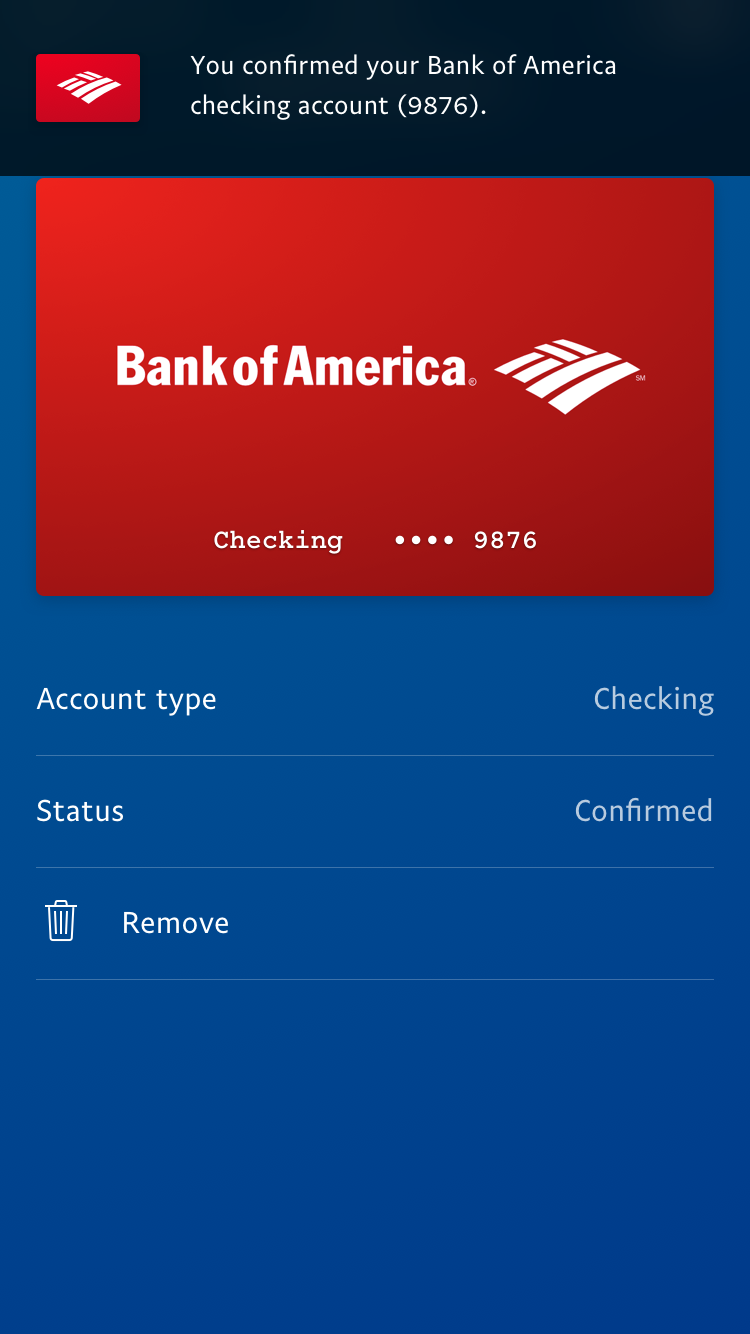

PayPal Wallet

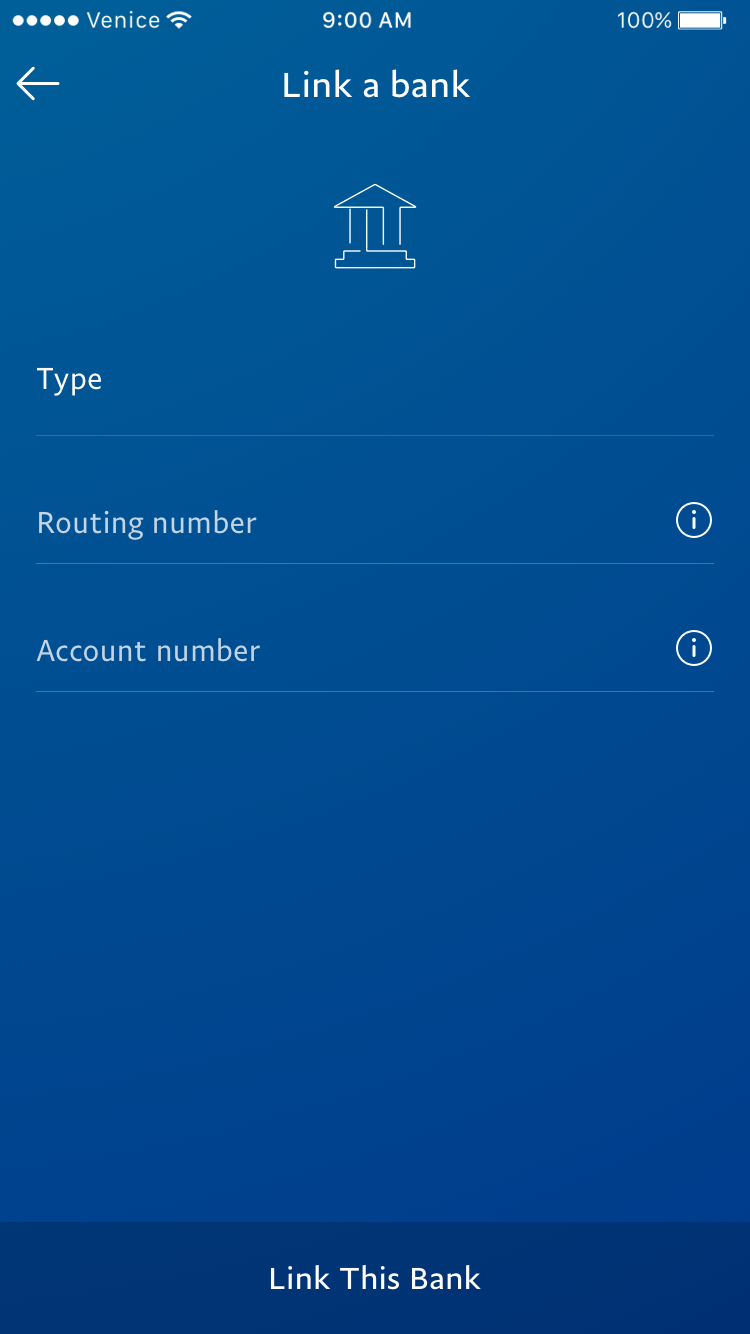

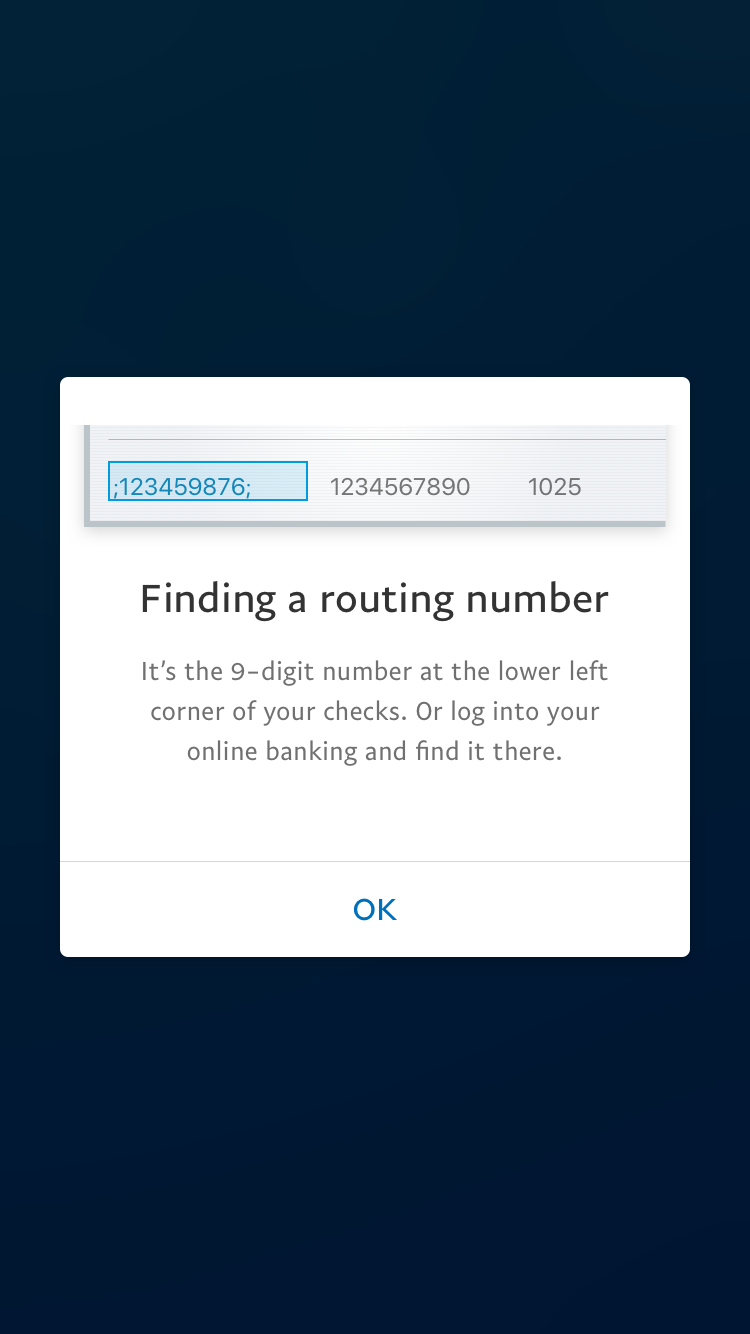

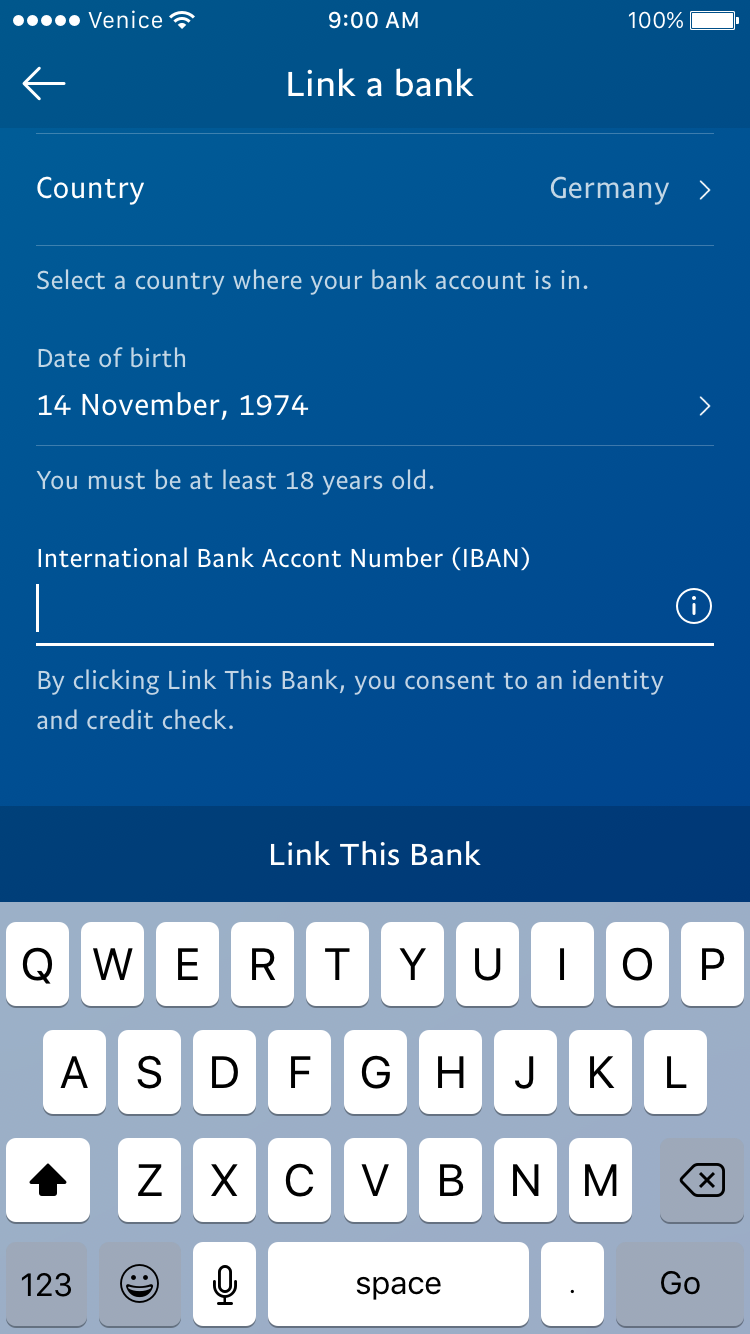

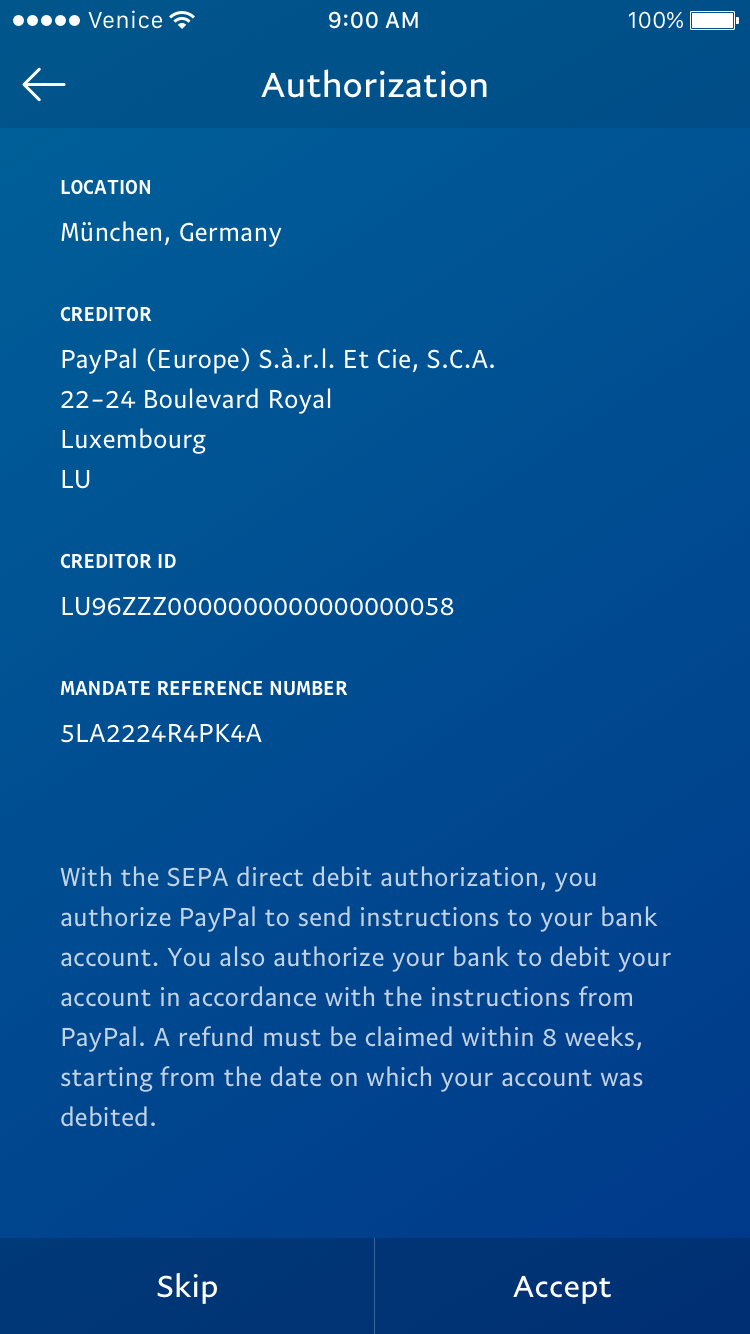

The newly-designed PayPal consumer mobile app, or Venice, was released in late January 2016. One of the features that the app did not support in its first release was the ability to let people add their bank.

This feature was a high priority for us as it would increase customer acquisition as well as unlock more features for them, making the app easier to use. I led the designs and subsequently became the owner of the entire Wallet section of the app.