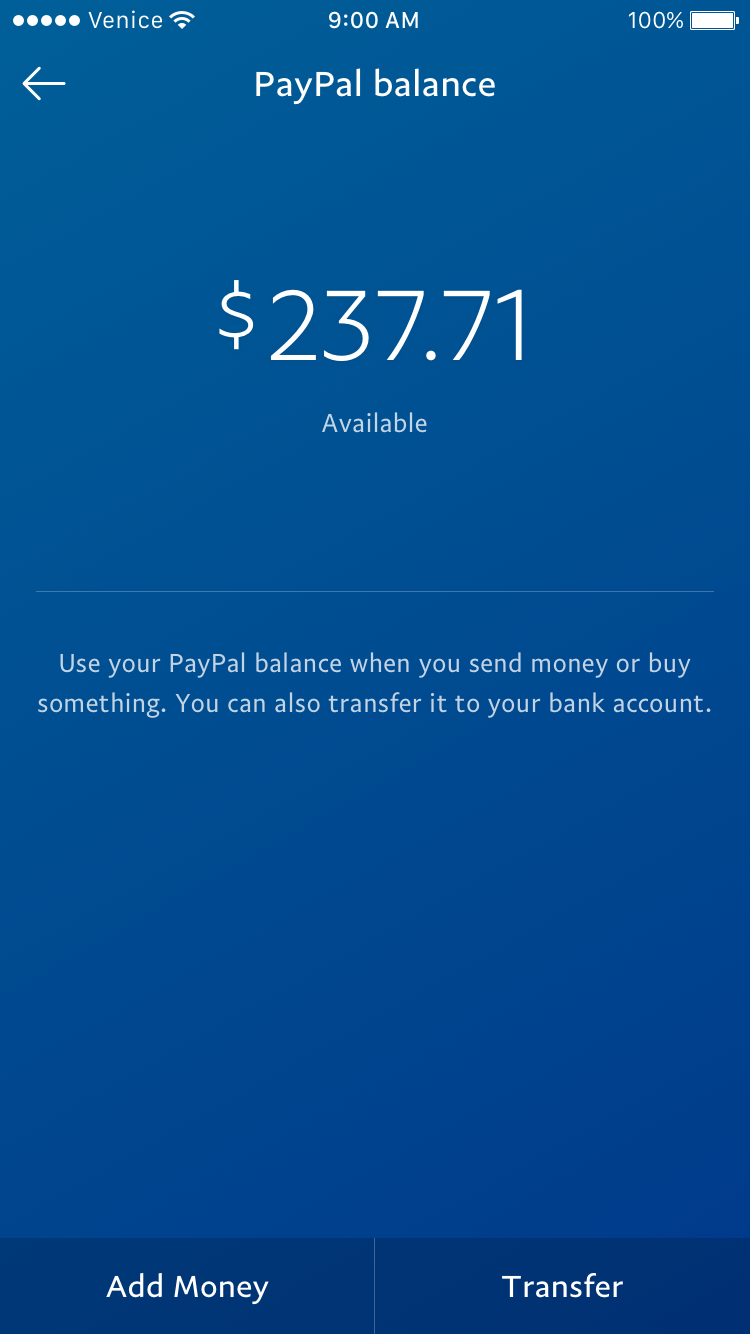

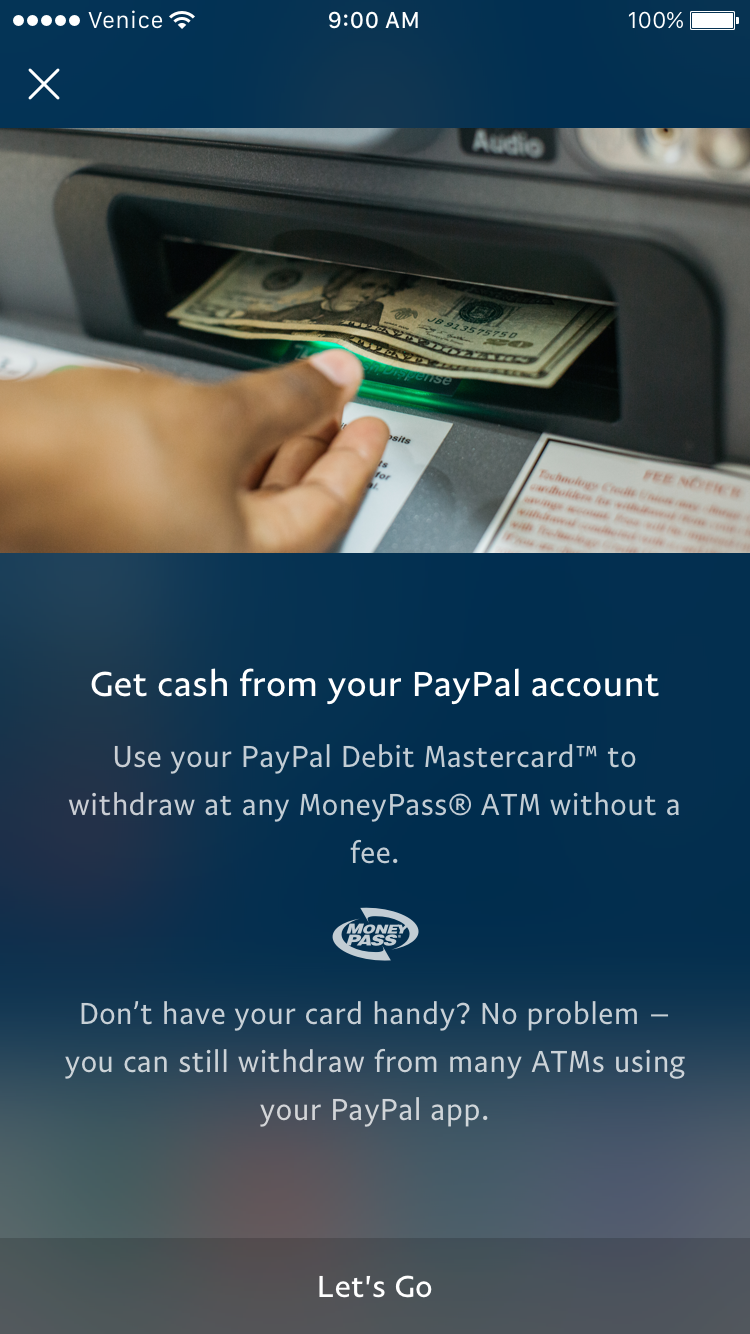

Although PayPal is an online digital payments company, 85% of the worlds transactions are still done in cash, which means cash is still king.

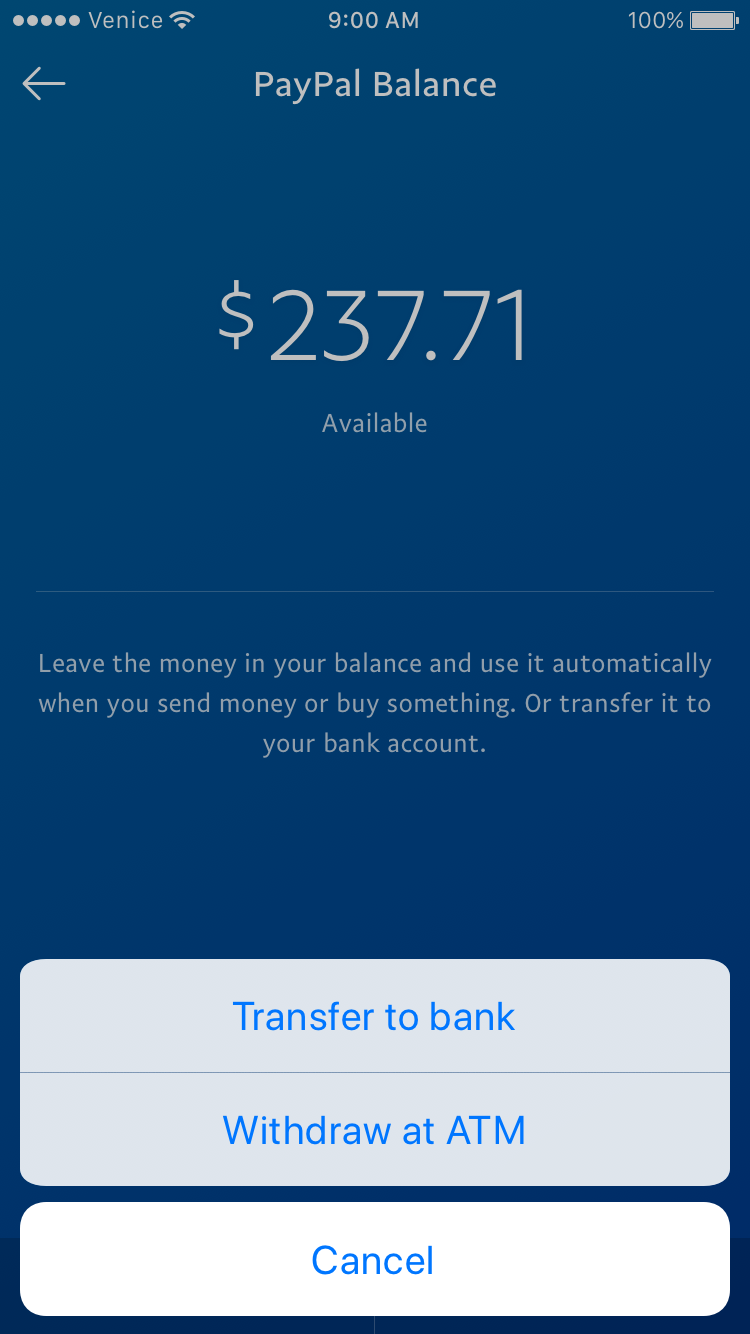

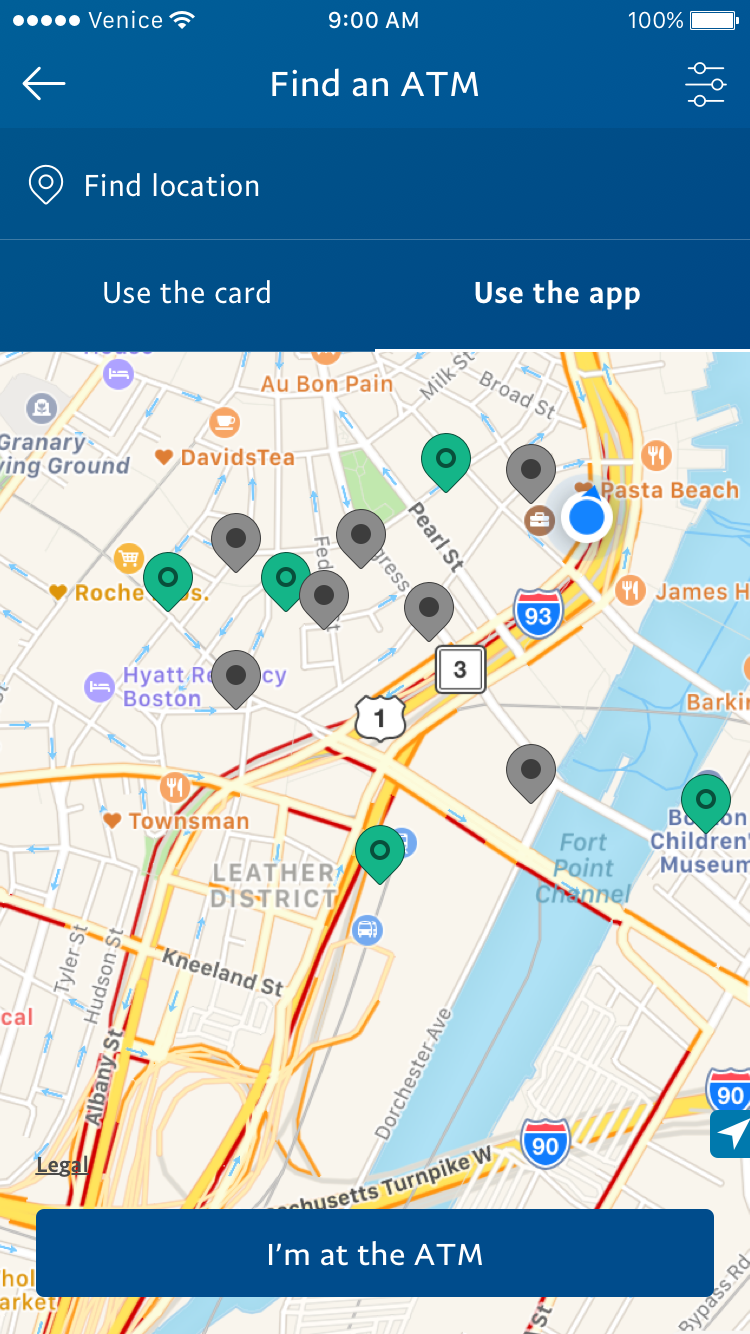

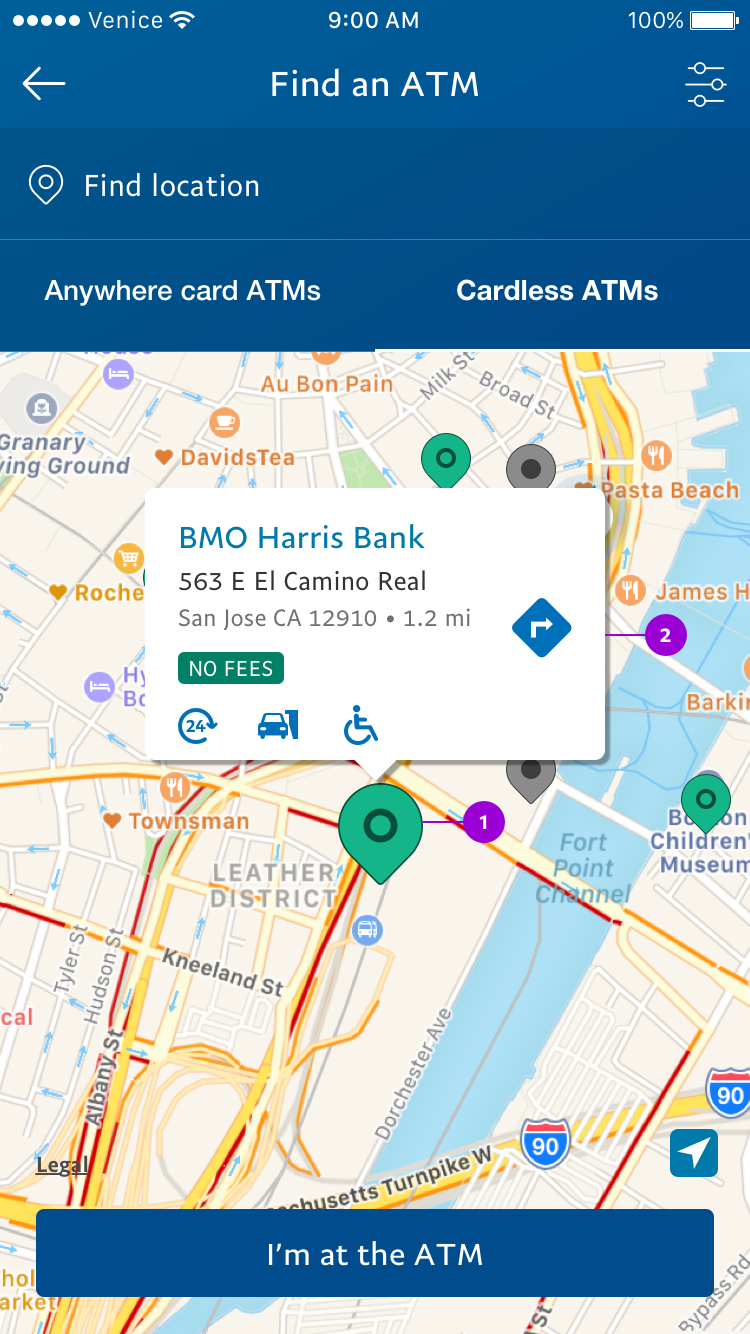

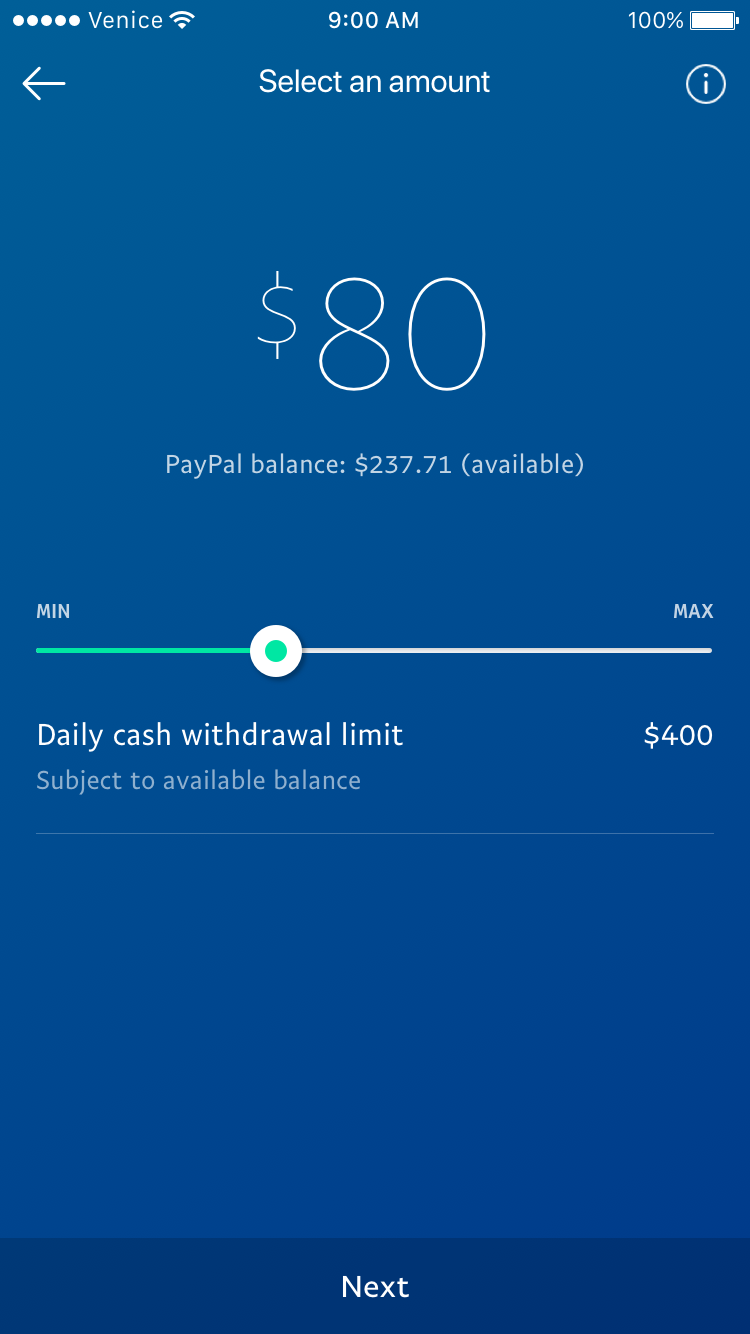

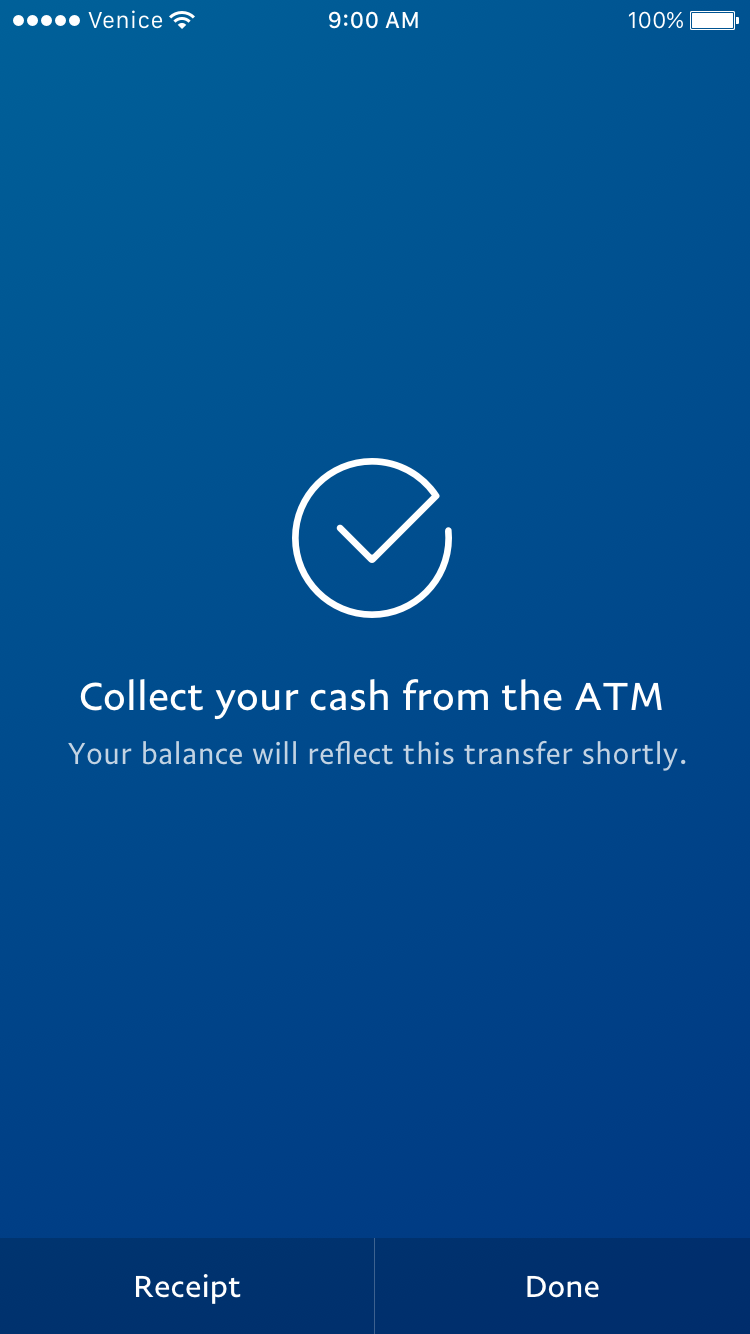

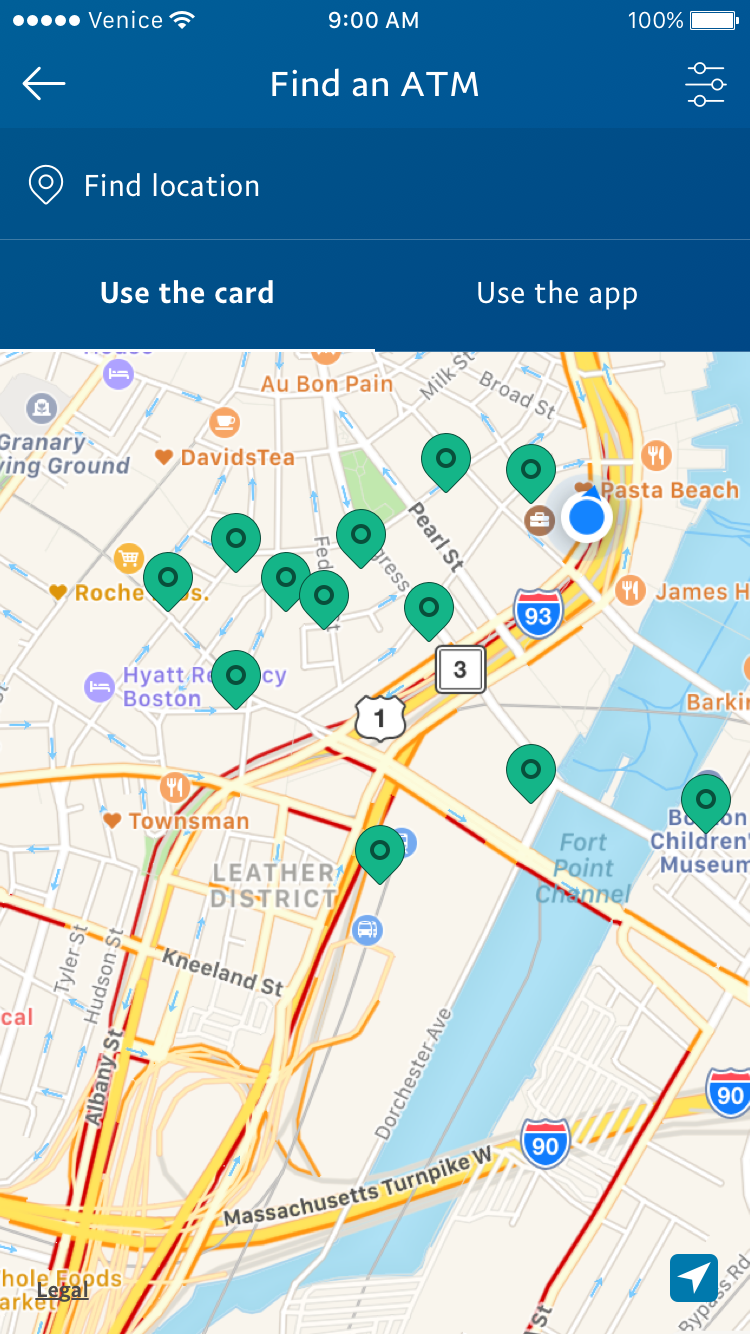

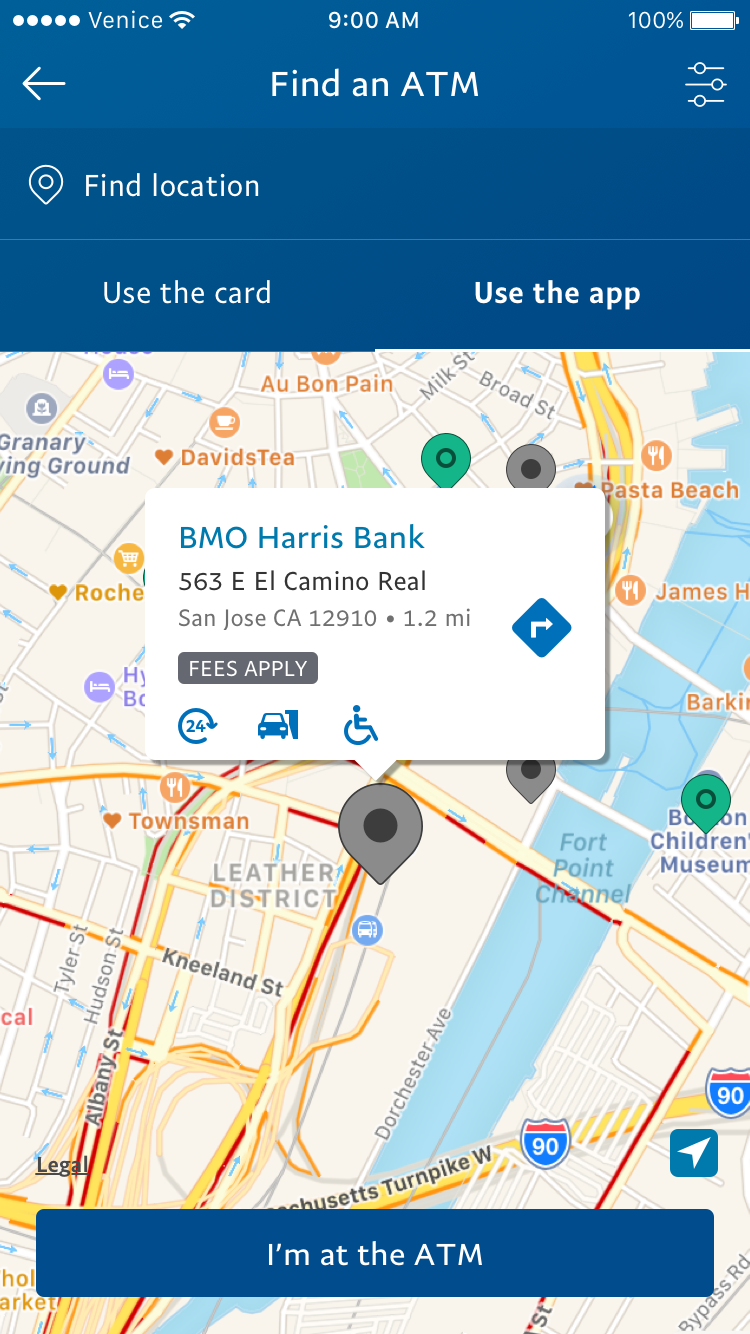

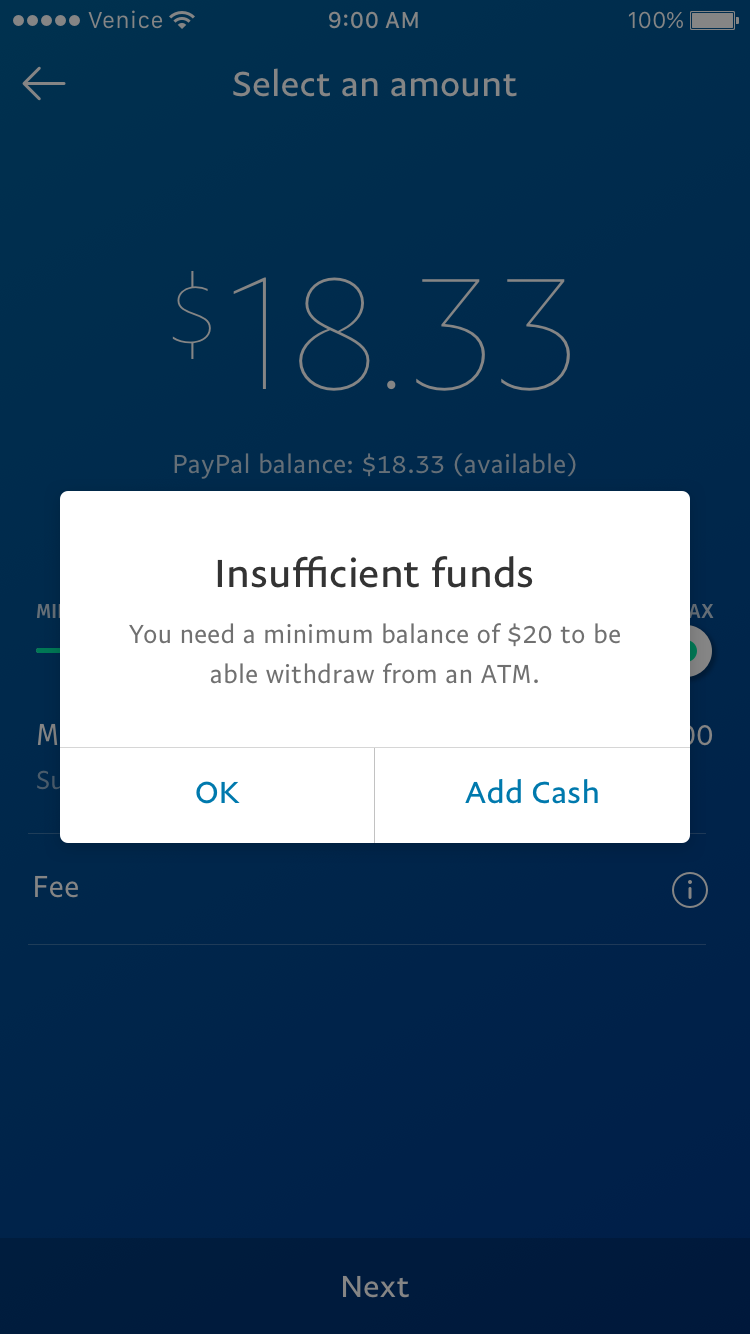

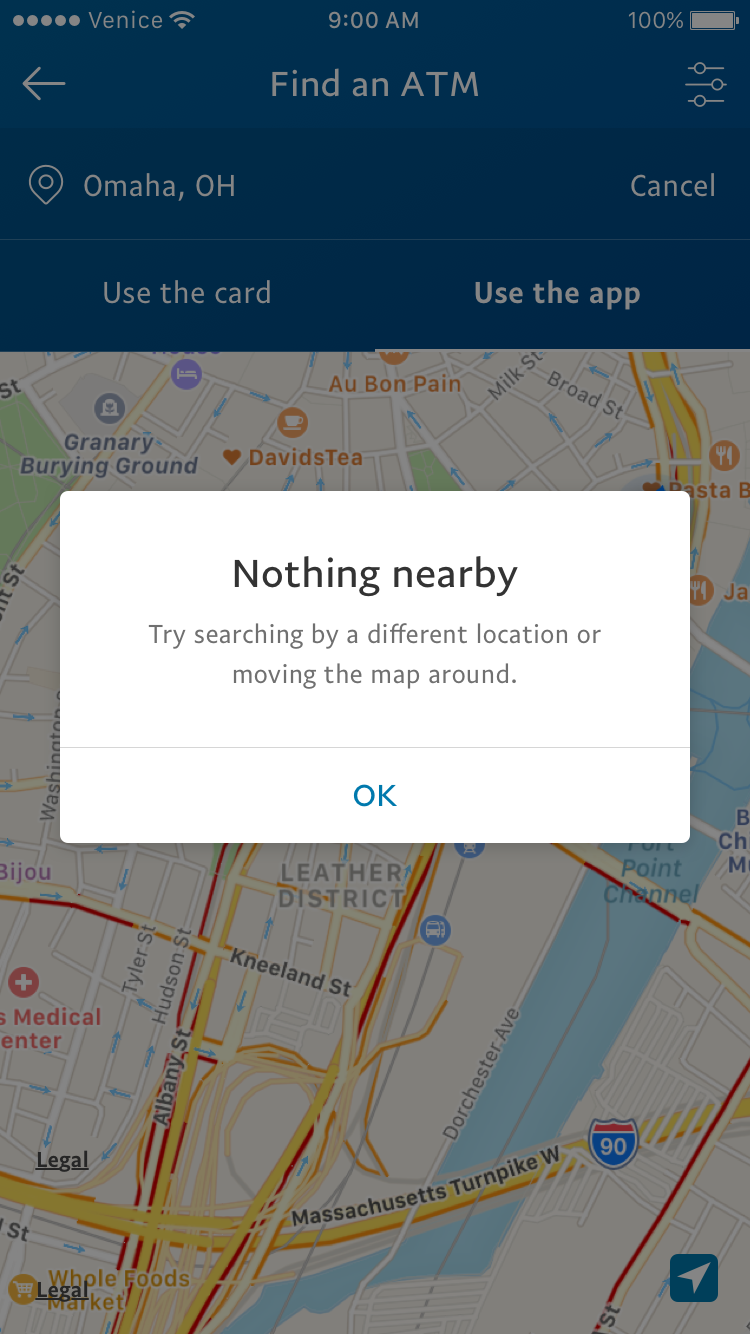

Most people use PayPal because of the security but how can we make the ATM experience more secure? Well if you use the app to withdraw cash then there's no card, which means fraudulent activities like card skimming can't exist. Personal data is stored in the cloud so it's never part of the transaction and you can cut transaction time down from an average 40 seconds to under 10 seconds! Being a global technology company, PayPal wanted to help to make the ATM experience more secure and faster.